Dominion Energy Stock Dividend Cut

The consensus price target on the stock is 84 15.

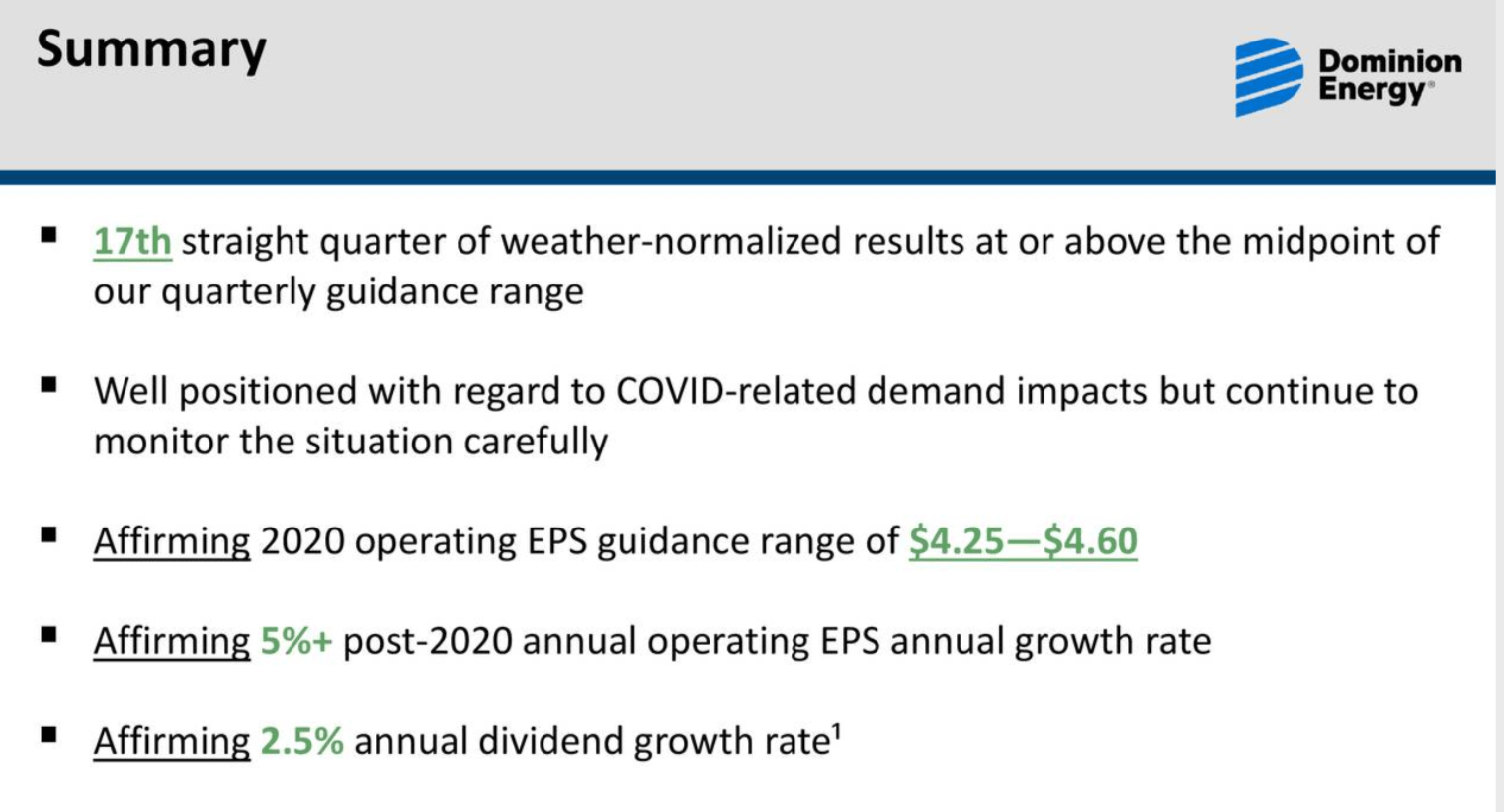

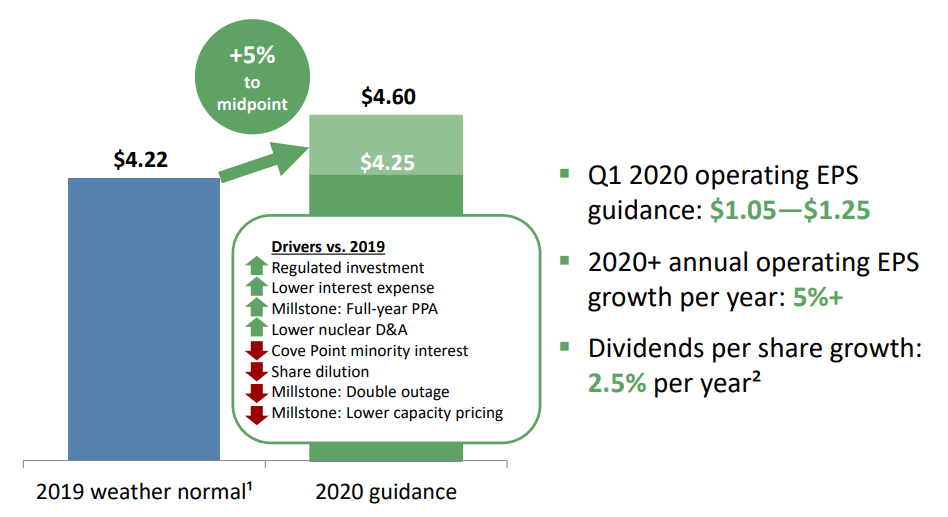

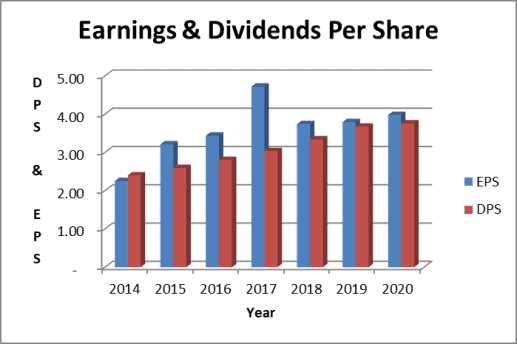

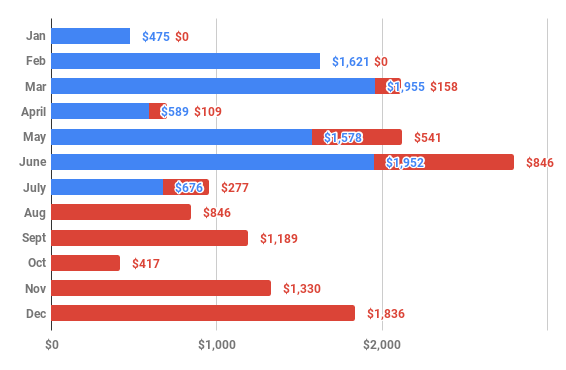

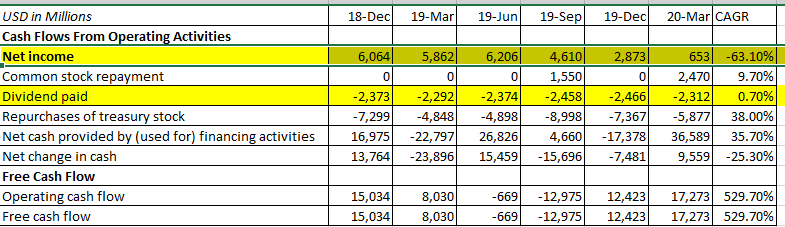

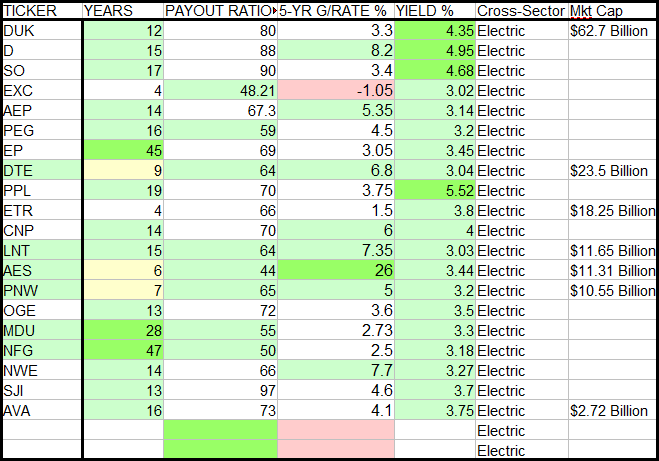

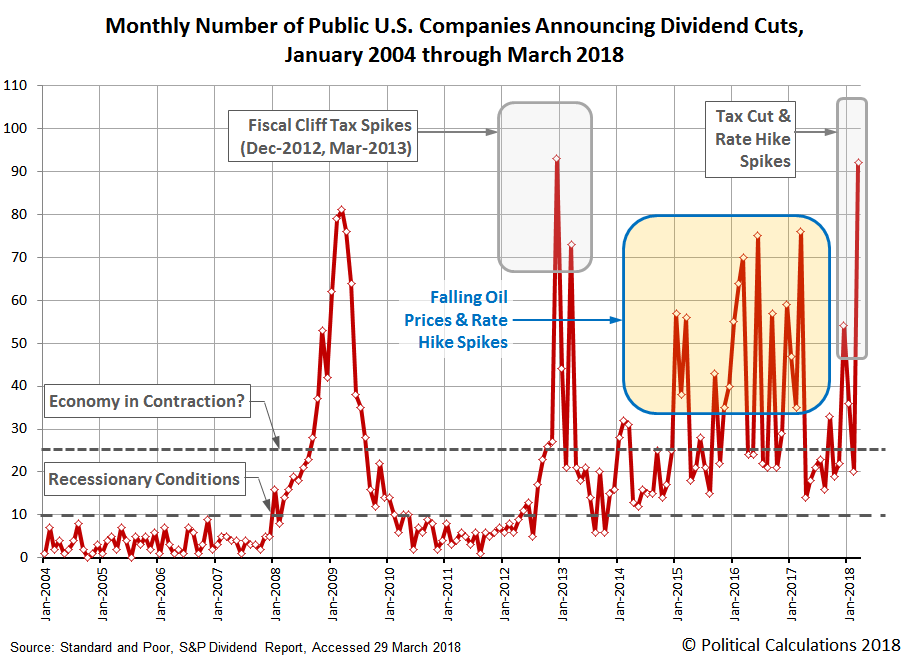

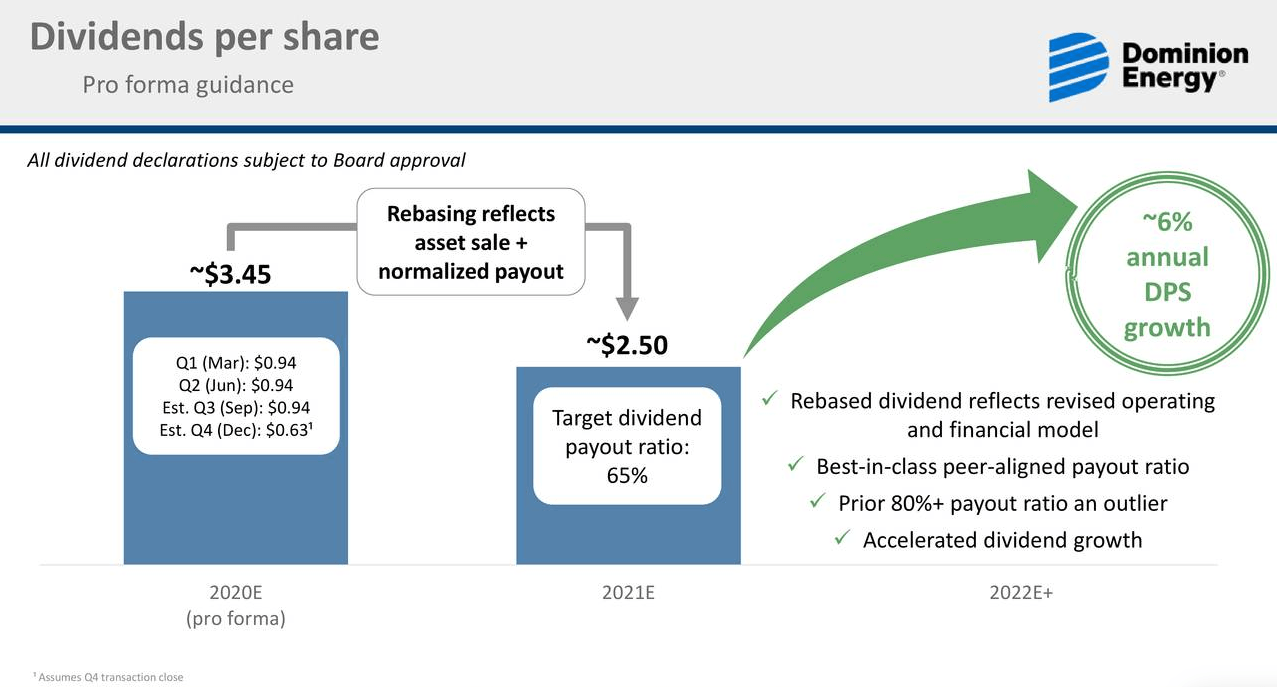

Dominion energy stock dividend cut. Dividends on dominion energy common stock are paid as declared by the board of directors. Find the latest dividend history for dominion energy inc. Utility dominion energy nyse d announced that it was making a big change. And selling the midstream operations will boost projected annual earnings growth to a range of 10 to 11 percent for 2021 with 6 5 percent a.

Based on the current stock price the forward dividend yield will be about 3 3. Dominion s stock traded up about 0 6 shortly before noon tuesday at 74 06 in a 52 week range of 57 79 to 90 89. Final thoughts on dominion. Dominion does plan to buy back 3 billion in stock.

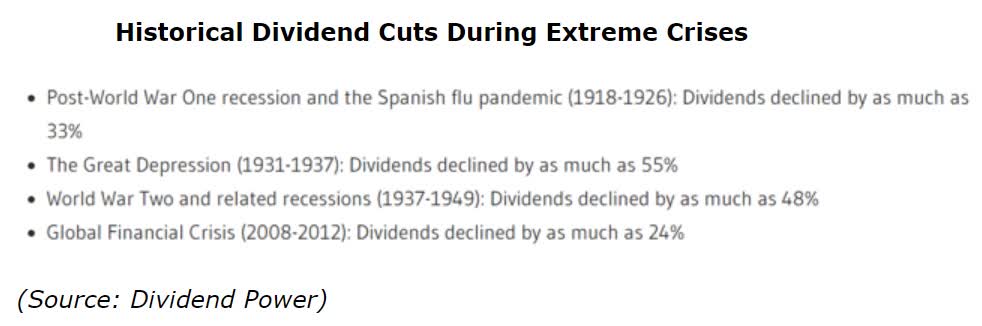

That s a significant reduction. For dividend purchases please note the purchase will still take place on the wednesday following the payable date. Dividends can be paid by check or electronic deposit or may be reinvested. Despite the dividend cut by dominion it is still a decent stock for those seeking income.

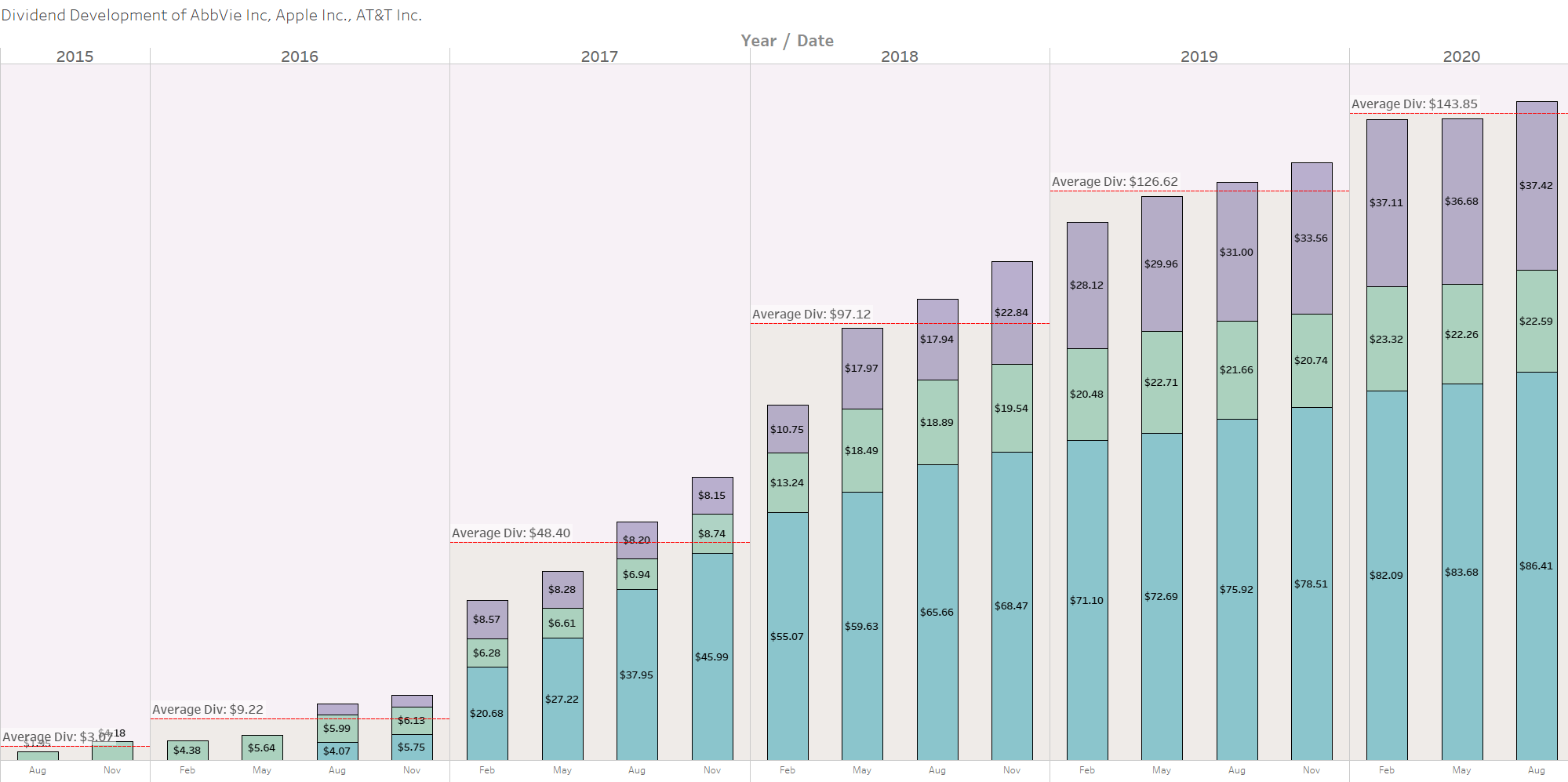

Proceeds will be about 3b as the deal includes the assumption of 5 7b in debt and taxes. In early july giant u s. Dividends are typically paid on the 20th day of march june september and december. Dominion energy and duke energy cancel the atlantic coast pipeline.

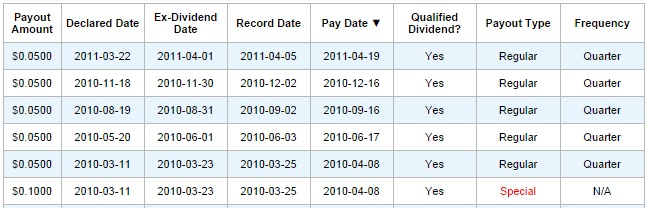

The company is selling assets to berkshire hathaway. Click here for stock split information. D s most recent quarterly dividend payment was made to shareholders of record on sunday september 20. Select my state select state idaho north carolina gas north carolina electric ohio south carolina utah virginia west virginia wyoming go to this state s site.

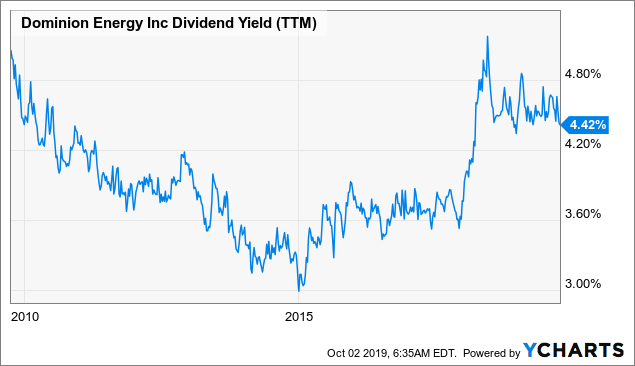

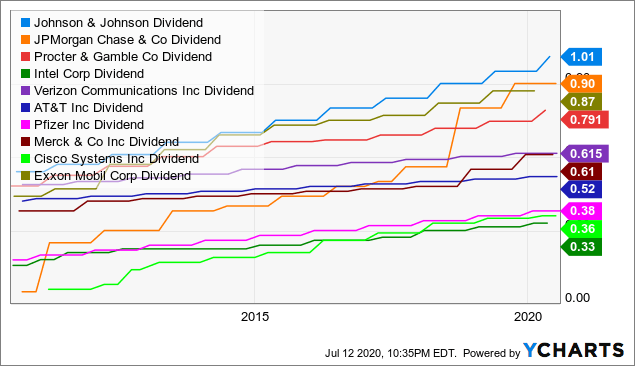

In order to serve you better please select your dominion energy location services. I just learned that dominion energy d is going to cut annual dividends to 2 50 share from 3 76 share. Clearly one can do much worse when seeking income. Dominion energy pays an annual dividend of 3 76 per share with a dividend yield of 4 82.

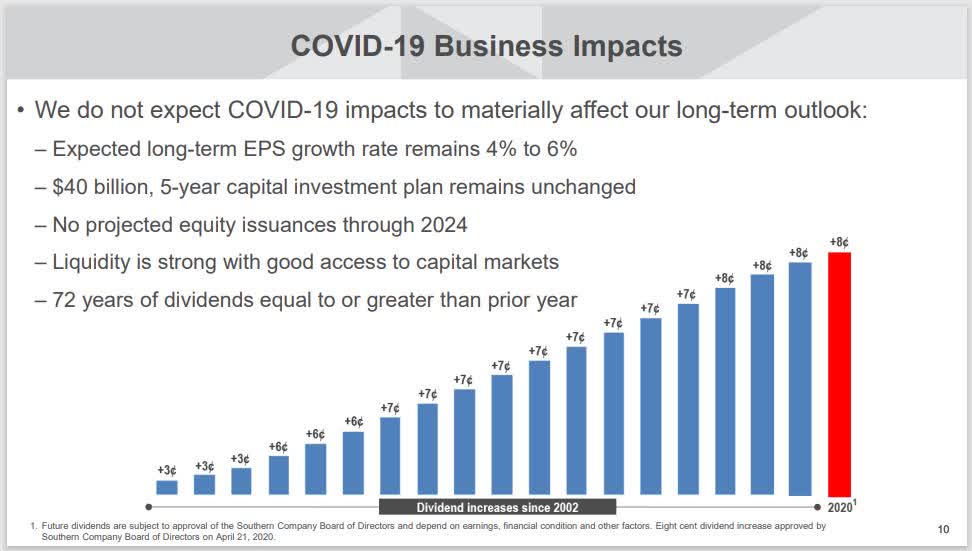

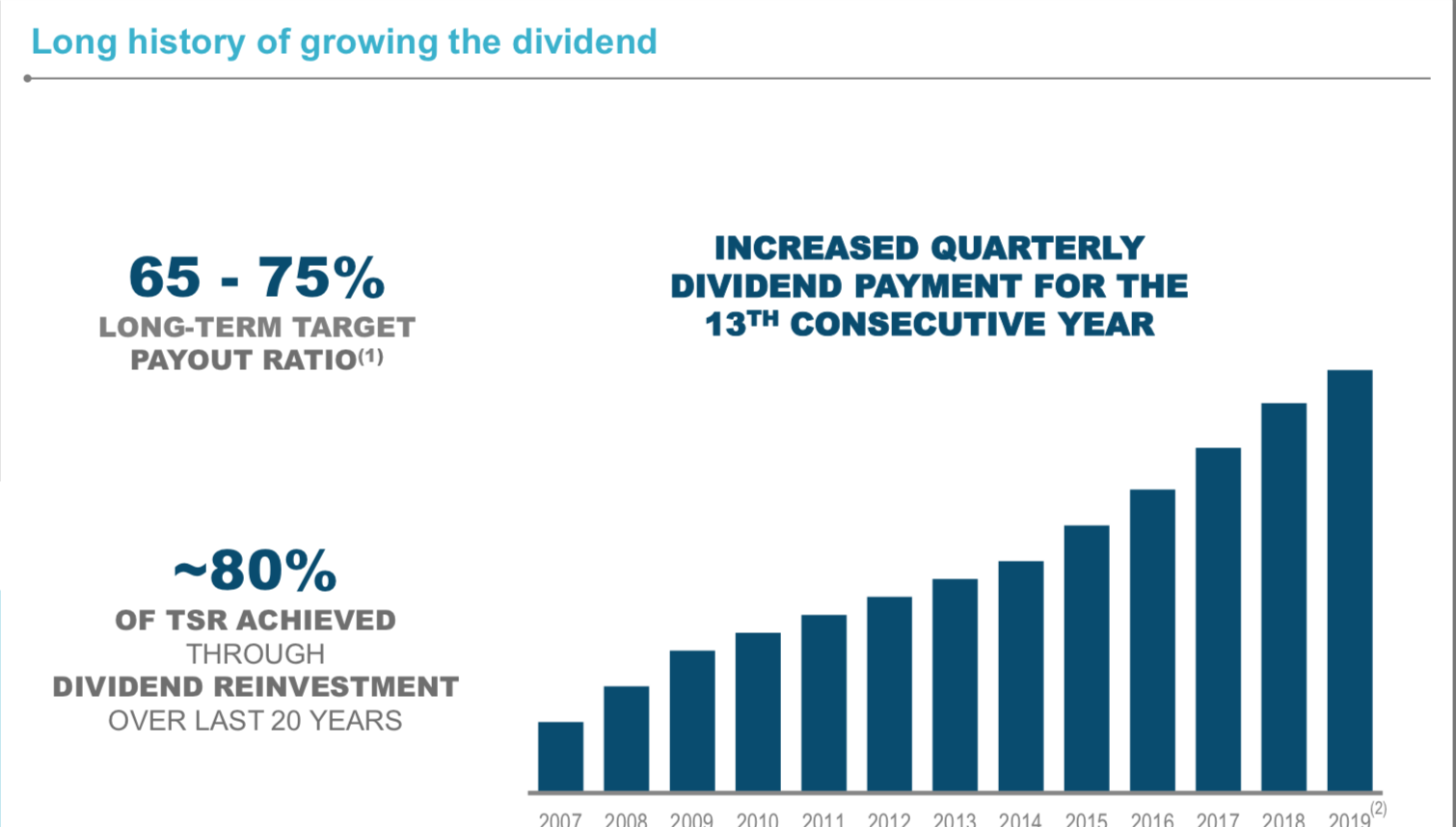

This ends an 18 year track record of annual dividend increases. The company has grown its dividend for the last 1 consecutive years and is increasing its dividend by an average of 9 44 each year.