Dmm Vs Floor Broker

This can include more than one.

Dmm vs floor broker. They are independent members of the exchanges on which they trade and they work from physical trading floors. The floor brokers specialists and designated market makers dmms on the trading floor are the face of. But the order is not received by the dmm until after 4 00 p m. But before the closing print because of system processing time the dmm should take this interest into account when formulating the close.

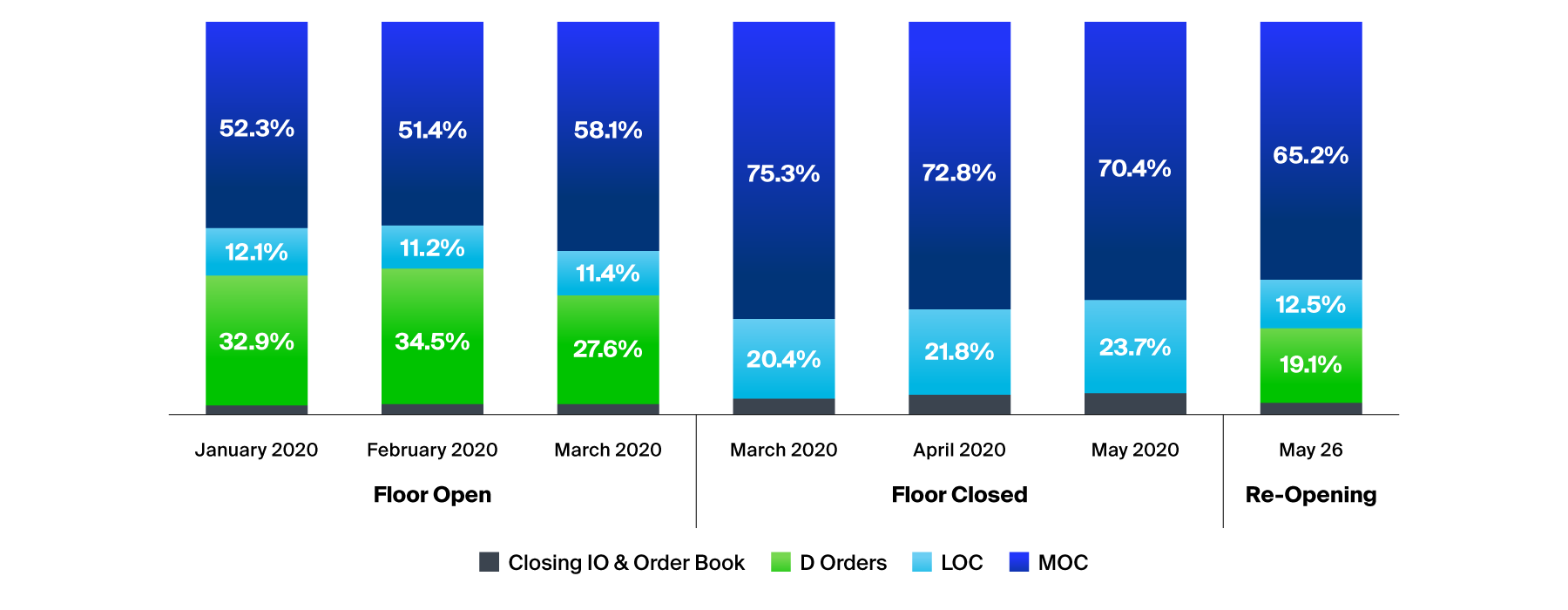

However our understanding is that there are now more market and limit on close orders left unfilled which get canceled back to the buyer or seller who is typically an institutional customer. Quotes offered by the dmm are on par with what floor brokers offer and the dmm is obligated to quote at the national best bid or offer for a percentage of the time. The storied new york stock exchange in lower manhattan is a symbol of american capitalism. With the floor closure and no manual dmm or floor broker processes nyse is using an electronic facilitated auction which also uses price range boundaries.

The floor broker electronically enters an order before 4 00 p m.

:max_bytes(150000):strip_icc()/GettyImages-1195603075-7e8dc700af47458e9b4f03a91c1397d8.jpg)

/GettyImages-149260742-64d8d0b49a4c45478d54394afbfed905.jpg)

/USStocksOddLots20142019-e2f26380af114d4eae1b22248764bc70.jpg)

/MythsaboutWallStreet-c10a9cee9fc2496fb9da5b8150334f94.jpg)

/GettyImages-1027438182-1a28c6f99cbb45d990f5f041be23f622.jpg)